tax effective strategies for high income earners

As a refresher for 2021 FY the individual tax rates including medicare levy are. A donor-advised fund DAF is an investment account created to support charitable organizations.

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

One of the easiest ways to begin slashing your annual income tax bill is by.

. At the time of publication Congress is considering legislation that would eliminate this opportunity Just as it sounds this option allows high earners to bypass the. This might lead you to wonder what the best tax deductions for high-income earners are. The higher your income tax bracket the more beneficial this itemization is for you.

The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for. Build Your Team of Professionals You might build a. With a CRT high-income earners and small.

Creating retirement accounts is one of the great tax reduction strategies for high income earners. Health Savings Account Investing. The law permits you to deduct the amount you deposit into a tax-certified.

These deductions are allowed even if you. The more taxable income you have the higher your federal income. Qualified Charitable Distributions QCD 4.

It works by setting up a. When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden. Here are helpful tax strategies for high-income earners that help increase savings.

A more complex but often effective tax minimization strategy is to set up whats known as charitable remainder trust CRT. This is one of the most basic tax strategies for high income earnersthat you can take advantage of. So what are the top tax planning strategies for high income employees.

If you are an employee. If you wish to save tax. Because it allows you to take current and future year contributions.

If you are a taxpayer living in England or Wales you will pay 40 income tax for an income of over 50270 assuming a full personal allowance is available. 6 Tax Strategies for High Net Worth Individuals. As a high-income earner its vital to have a comprehensive understanding of the tax laws that apply to you.

Despite the increases of the standard deduction limits in recent years. Thankfully there are some tax strategies for high income earners you can do now to keep from overpaying this tax season. Family Income Splitting and Family Trusts.

Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI. Well this is precisely what we will cover in this section along with numerous other techniques to. Short-term capital gains tax is always the same as ordinary.

With a DAF you can make a. The TCJA aligned the long-term capital gains rates of 0 15 and 20 with maximum taxable income levels. Re-examine Standard or Itemized Deductions.

Effective tax planning with a qualified accountanttax specialist can help you to do. This is one of the most basic tax strategies for high income earnersthat you can take advantage of. Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden.

Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners. Contribute to your Superannuation. 50 Best Ways to Reduce Taxes for High Income Earners.

How to Reduce Taxable Income. Tax Saving Strategies for High Income Earners 1. Here are 50 tax strategies that can be employed to reduce taxes for high income earners.

Your mortgage interest on a loan up to 750000 is a line item for itemizing deductions. If you are a high-income earner it is sensible to implement tax minimisation strategies. In some situations higher income means adjusted gross income or AGI of 186000 for IRA contributions or 315000 for the new business income deduction for.

Why It Matters In Paying Taxes Doing Business World Bank Group

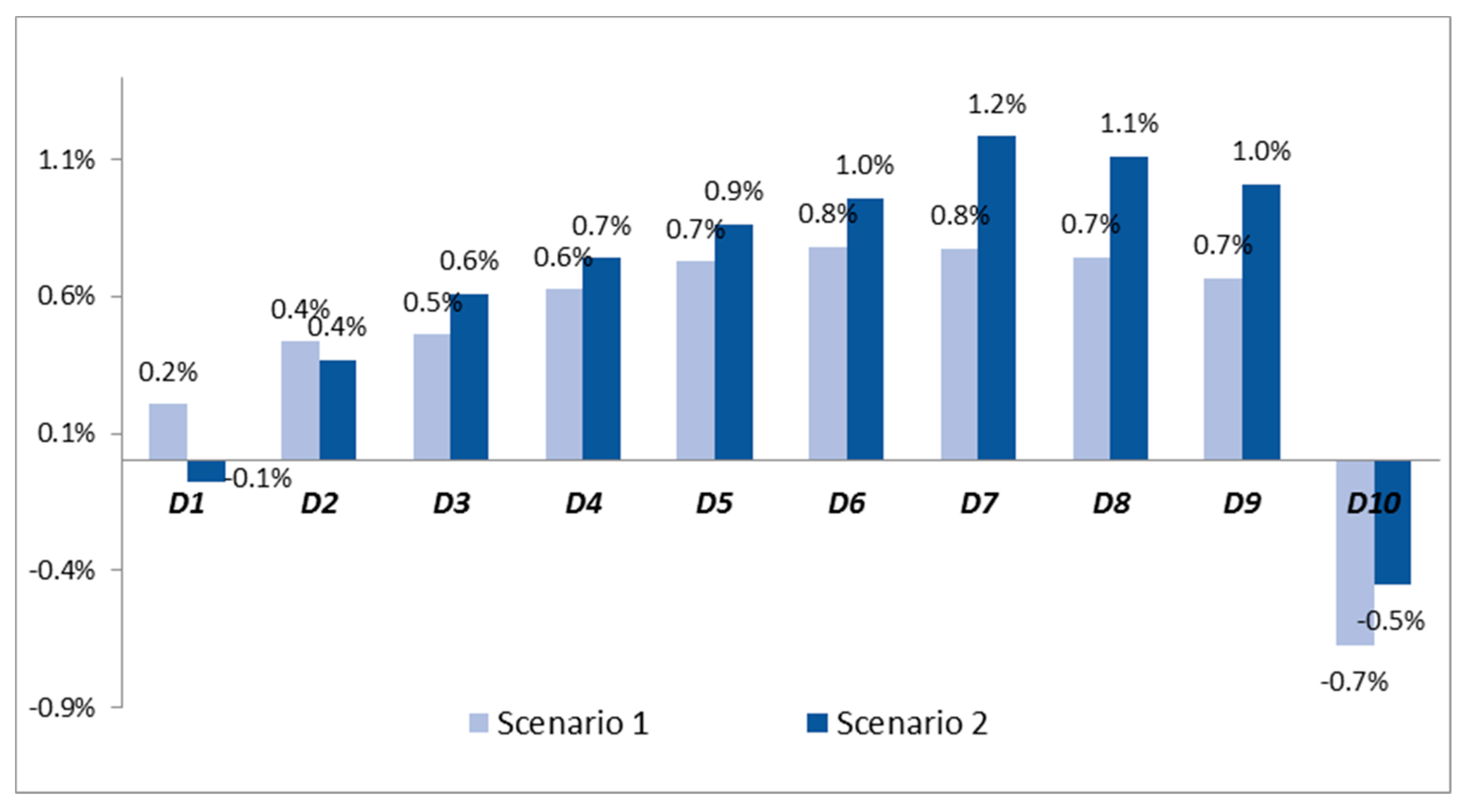

Sustainability Free Full Text Flat Rate Versus Progressive Taxation An Impact Evaluation Study For The Case Of Romania Html

How Do Taxes Affect Income Inequality Tax Policy Center

When An Llc Actually Needs An Accountant A Simple Checklist By Matt Jensen Taxes Taxeseason Taxesdone Taxesmiam Small Business Tax Business Tax Llc Taxes

High Income Earners Need Specialized Advice Investment Executive

The 4 Tax Strategies For High Income Earners You Should Bookmark

How Do Taxes Affect Income Inequality Tax Policy Center

Why It Matters In Paying Taxes Doing Business World Bank Group

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Minimisation Strategies For High Income Earners

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

What Is Wrong With The American Tax System For The Middle Class Finance Organization Finance Planner System

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

How Do Taxes Affect Income Inequality Tax Policy Center

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Do Taxes Affect Income Inequality Tax Policy Center

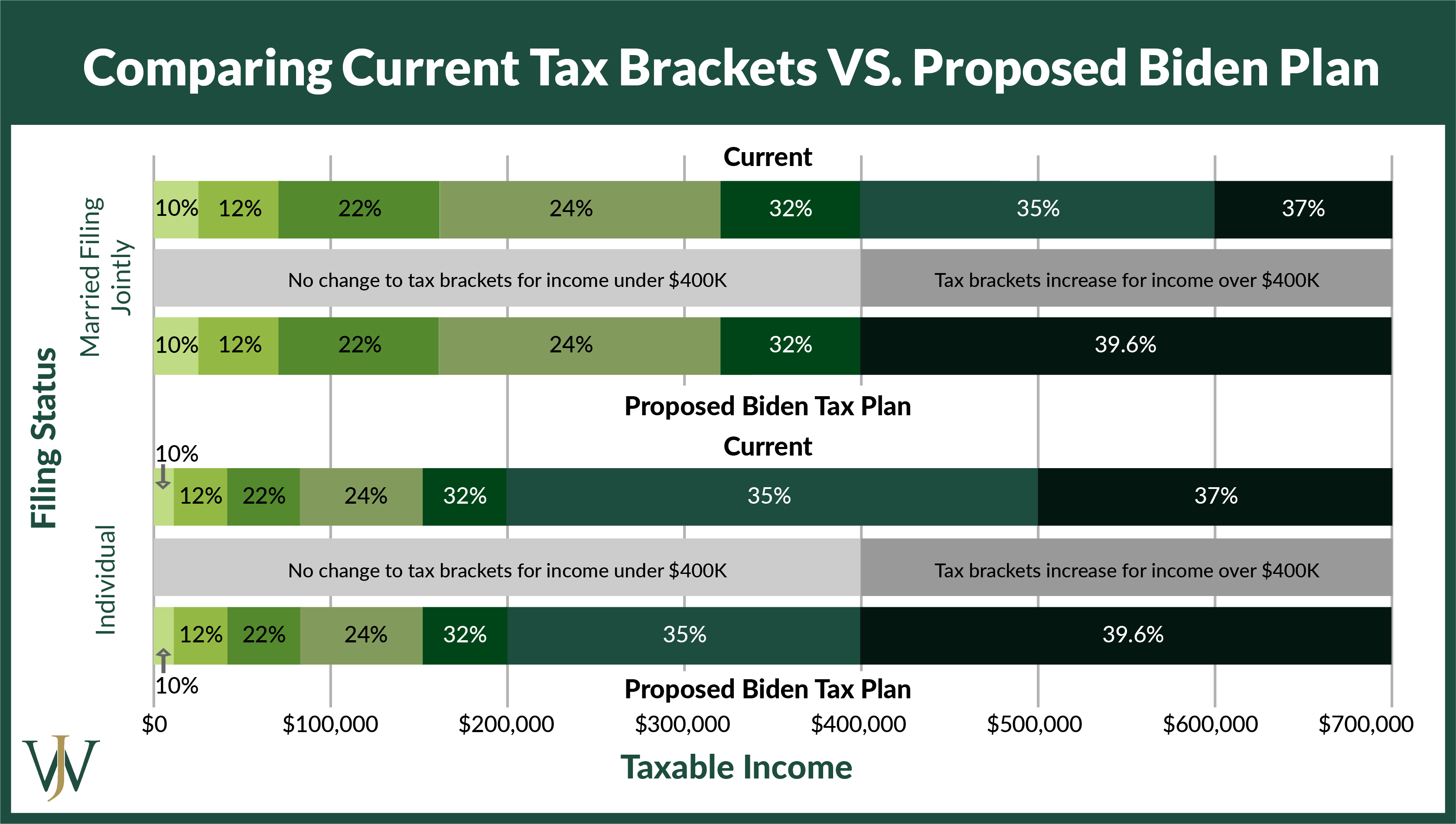

Biden S Tax Plan Explained For High Income Earners Making Over 400 000